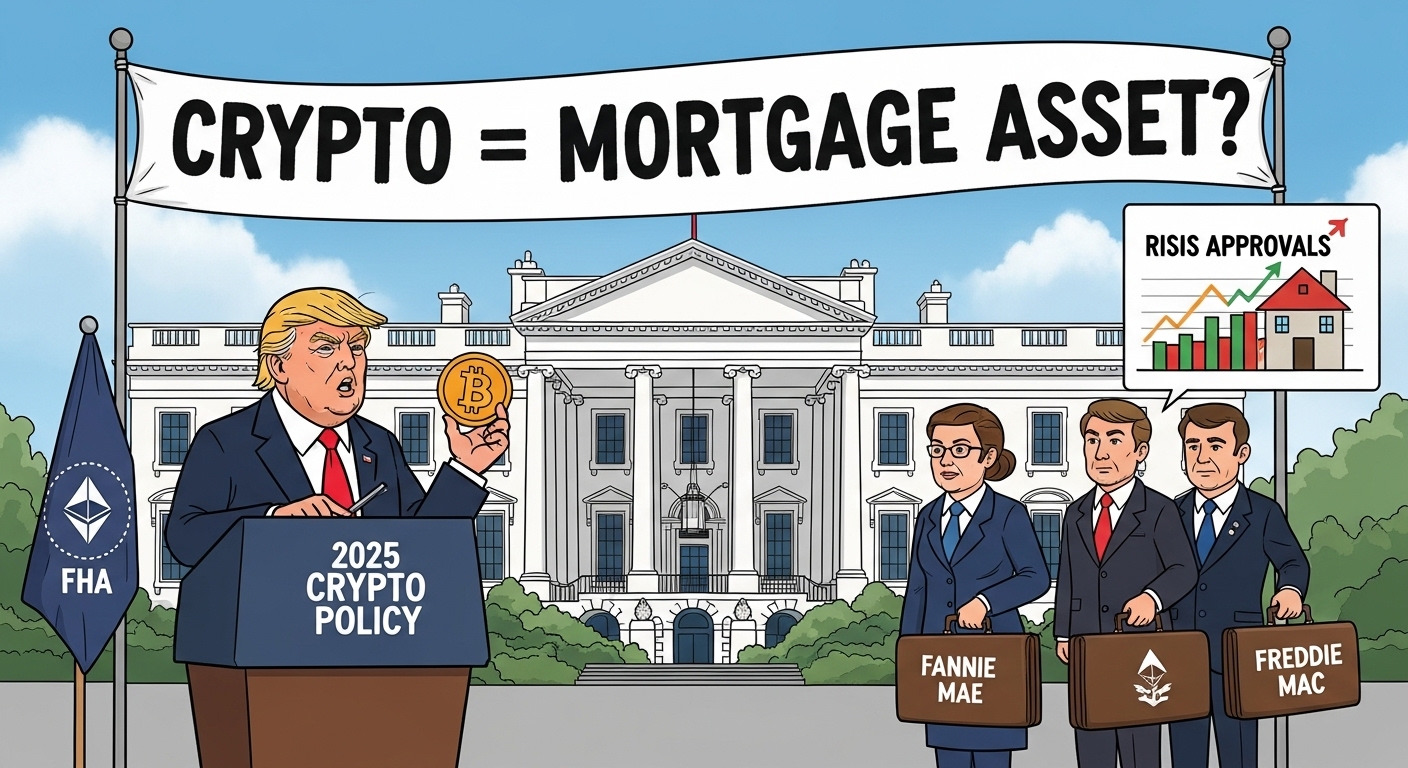

Trump Administration Pushes for Crypto to Be Counted in Federal Mortgage Assets

I’ll be honest – I didn’t think the Trump crypto mortgage asset plan would actually happen this fast.

My friend who works in mortgage lending texted me last week saying “did you see what just happened?”, when people ask can I use crypto as a mortgage asset. I used to tell them “not in your lifetime.” Well, I was wrong.

The Federal Housing Finance Agency just forced every major mortgage company to completely rethink how they evaluate people’s money – and if you’ve got cryptocurrency, this could change everything for you.

This isn’t some small regulatory tweak buried in government paperwork. William Pulte, the guy running FHFA, literally ordered Fannie Mae and Freddie Mac to figure out how to count your Bitcoin and Ethereum when you apply for a mortgage.

We’re talking about a complete shift in the crypto mortgage asset policy USA that could help millions of people finally use their digital assets to buy homes.

What Actually Happened

Pulte signed this directive on a Wednesday, and frankly, it caught most people off guard. The FHFA crypto directive doesn’t mess around – it tells both mortgage giants they need to create real proposals for accepting crypto as mortgage asset holdings without forcing people to sell everything first.

Here’s what gets me excited about this: Pulte actually posted on social media saying this aligns with Trump’s goal to make America “the crypto capital of the world.” The Trump housing crypto update isn’t just talk anymore – it’s actual policy that affects real people trying to buy real houses.

For years, banks have treated cryptocurrency like it doesn’t exist when you walk in for a mortgage. Your $200,000 in Bitcoin? Might as well be Monopoly money according to their underwriters. The federal housing crypto policy is finally catching up to how people actually build wealth these days.

Who This Actually Helps

Let me tell you about my neighbor Dave. He’s a contractor who started buying Bitcoin back in 2019 when everyone thought he was crazy. Now he’s sitting on about $300,000 in crypto, but when he tried to buy a bigger house last year, the bank told him to sell it all and pay the taxes before they’d even look at his application.

Under the Trump housing policy crypto asset integration, Dave might not have to make that choice anymore. The Fannie Mae crypto acceptance rules being developed could count his digital assets the same way they’d count his stock portfolio. That’s huge for people who’ve built serious wealth through cryptocurrency but got locked out of homeownership because of outdated banking rules.

This change particularly helps younger Americans who chose crypto over traditional investments. I know plenty of people in their twenties and thirties who have more money in digital assets than in savings accounts. The Freddie Mac digital asset policy development finally acknowledges that reality.

The Fine Print You Need to Know

Don’t get too excited yet – there are some strict requirements coming with these crypto assets allowed in home loan applications. Your cryptocurrency has to be stored on U.S.-regulated exchanges that follow all the government rules. So if you keep your coins on Coinbase or Kraken, you’re probably good. But if they’re sitting on some sketchy overseas platform, forget about it.

The new mortgage asset rule for crypto 2025 also requires both agencies to account for volatility. Look, I’ve watched Bitcoin go from $30,000 to $70,000 and back down to $40,000 all in the same year. Banks know this too, which is why they’re not going to treat your $100,000 crypto portfolio like it’s $100,000 in cash sitting in a savings account. They’ll probably cut it down to $70,000 or maybe $80,000 when they’re figuring out if you qualify.

When people call and ask can I qualify for a home loan with cryptocurrency, I have to tell them the truth: nobody knows yet exactly how this will work. The mortgage loan crypto reserve rule is literally being written as we speak. But here’s what I do know – the fact that it’s happening at all is huge. Two years ago, this conversation wouldn’t even be possible.

Why This Matters for the Housing Market

The timing here is interesting. Home sales have been terrible for the past couple years because of high mortgage rates and expensive houses. Maybe bringing crypto reserves mortgage asset approval into the mix will help some people who’ve been sitting on the sidelines.

Think about it – there are probably hundreds of thousands of Americans with substantial cryptocurrency holdings who couldn’t qualify for mortgages under the old rules. The federal housing crypto policy under Trump could unlock a lot of buying power that’s been stuck in digital wallets.

My real estate agent friend told me she’s already had several clients ask about use bitcoin as mortgage asset approval USA possibilities. I know a guy who bought Ethereum back in 2020 and now he’s got more money in crypto than most people have in their entire retirement accounts. When he tried to get a mortgage last year, the bank treated him like he was unemployed. That’s not fair, and it’s certainly not smart business. These are people who saw an opportunity and took it – they shouldn’t be punished for being early to a good investment.

What’s Going to Happen Next

Here’s the reality of how government works: both Fannie Mae and Freddie Mac now have to write up detailed plans for how they’ll handle crypto assets. Their boards have to approve everything, then the FHFA gets the final say. If you think you’re walking into Wells Fargo next month asking to use cryptocurrency as mortgage asset approval, you’re going to be disappointed. This stuff takes time.

The FHFA mortgage rule change is actually a bigger deal than most people realize. When these two agencies change how they do business, every mortgage lender in America has to follow along. They’ve been calling the shots since the government took them over back in 2008.

My prediction for the Fannie Mae digital asset update timeline? We’ll probably see rough proposals by summer, but don’t expect your local bank to know what to do with your Bitcoin portfolio until sometime in 2025 or even 2026. Banks move slowly, and they’ll need time to figure out how to evaluate digital assets in housing finance without screwing it up.

What You Should Do Right Now

If you own crypto and you’re thinking about buying a house, here’s my advice: start getting your paperwork together today. The crypto-backed mortgage approval process is going to want to see everything – when you bought your crypto, how much you paid, what you own right now, and proof that it’s all stored on legitimate exchanges like Coinbase or Kraken.

I’m serious about this. Banks are going to be extra careful with the first crypto mortgage applications they see. Having your documentation organized and ready could be the difference between getting approved and getting rejected..

Don’t expect this to be a magic bullet that solves all your homebuying challenges. You’ll still need steady income, decent credit, and reasonable debt levels. The Trump administration crypto policy makes your crypto count as an asset, but it doesn’t eliminate the other requirements for getting a mortgage.

The Bigger Picture

This directive reflects something I’ve been saying for years – cryptocurrency as financial reserve holdings are becoming mainstream whether traditional banks like it or not. The real estate crypto regulation landscape is evolving rapidly, and smart policymakers are adapting instead of fighting it.

The bitcoin housing market policy development shows that the Trump administration is serious about embracing digital assets across all areas of government. This isn’t just about mortgages assets – it’s about recognizing that millions of Americans have built real wealth through cryptocurrency.

When the GSE crypto reserve guideline rules are finalized, we could see a significant shift in how people approach both investing and homebuying. The centralized exchange crypto mortgage asset requirements ensure proper oversight while giving crypto holders a path to homeownership that didn’t exist before.

The mortgage risk crypto integration challenge will be balancing innovation with responsible lending practices. But if they get this right, it could help thousands of people finally achieve the American dream of homeownership using the wealth they’ve built through smart crypto investments.

For anyone who’s been holding Bitcoin or Ethereum and dreaming of buying a house, this Trump administration policy change might be the break you’ve been waiting for. The rules are still being written, but the door is finally opening.