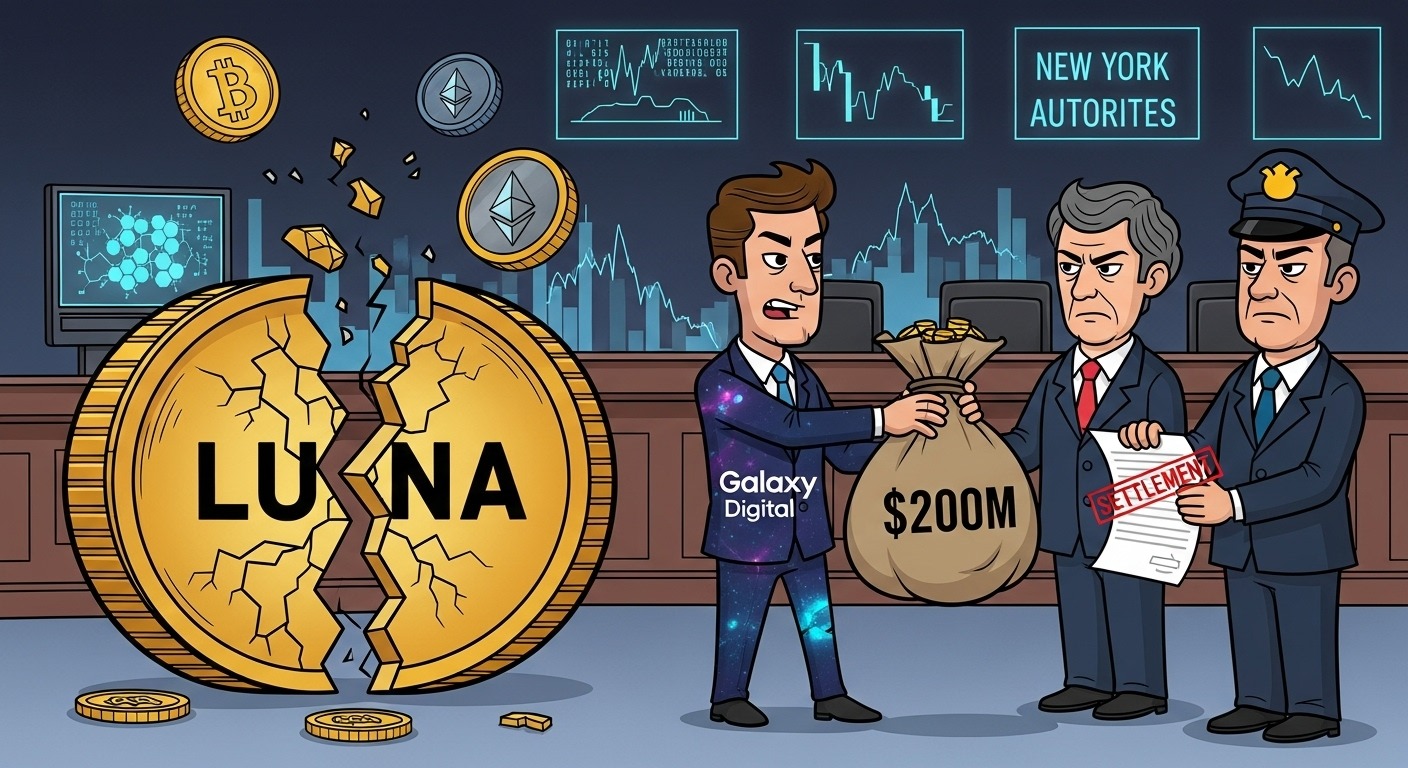

Luna Crypto Lawsuit Ends: Galaxy Digital Pays $200M to NY Authorities

Luna tokens Lawsuit came to an expensive conclusion when the Company Galaxy Digital agreed to pay $200 million to New York regulators. The luna crypto lawsuit had been building for months as investigators dug into the firm’s trading practices during the Terra Luna ecosystem’s rise and fall. Rather than risk an uncertain court battle, Mike Novogratz’s investment firm chose to settle all charges. This Luna crypto settlement signals a new era where cryptocurrency companies face the same regulatory scrutiny as traditional Wall Street firms.

Why Galaxy Digital Faced Legal Action

The Galaxy Digital lawsuit centered on a classic Wall Street problem: talking up investments while secretly selling your own positions. From late 2020 through 2022, Galaxy Digital’s public messaging consistently portrayed Luna tokens as solid investment opportunities. Their research reports, social media posts, and conference presentations all painted an optimistic picture of Luna’s potential.

Behind the scenes, however, Galaxy was methodically selling millions of dollars worth of their own Luna holdings. This created a fundamental contradiction—the company was telling investors to buy the same asset they were actively selling. The Luna NY Attorney General investigation uncovered this dual strategy and found it violated basic disclosure requirements that protect retail investors.

What made this particularly damaging was the timing. Galaxy’s promotional activities intensified just before Terra Luna’s catastrophic collapse in May 2022. When the ecosystem imploded, ordinary investors who had followed Galaxy’s guidance lost everything, while the firm had already reduced its exposure through strategic sales.

How the $200 Million Settlement Works

The $200M crypto fine does more than just punish Galaxy Digital for past behavior. New York regulators designed this settlement to prevent similar problems from happening again across the crypto industry. Galaxy can spread their payments over three years, which keeps the company operational while ensuring they pay the full penalty.

The Mike Novogratz Galaxy settlement includes mandatory changes to how Galaxy operates. The company must now implement strict conflict-of-interest policies, conduct legal reviews before making any promotional statements about digital assets, and maintain transparent disclosure practices. These requirements essentially force Galaxy to operate like a traditional investment firm when it comes to compliance and disclosure.

How the Token Manipulation Actually Worked

The Luna token manipulation scheme was straightforward but devastating. Galaxy would use their platform and influence to talk up Luna investments. Meanwhile, they were selling their own holdings without telling anyone. It’s the crypto version of a used car salesman telling you a car is perfect while secretly knowing the engine is about to blow up.

The NYAG crypto enforcement team didn’t have to look too hard to find the evidence. Digital transactions leave clear trails, and promotional materials with timestamps make it easy to see when companies were talking up assets they were simultaneously dumping.

The Bigger Picture: Terraform Labs Connection

Understanding Galaxy’s role requires looking at the broader Terra Luna ecosystem collapse. The Terraform Labs Luna collapse settlement addresses a different set of issues than Galaxy’s case. Terraform Labs, led by Do Kwon, developed the actual Terra blockchain and Luna token technology. Galaxy Digital, meanwhile, operated as a major investor and promoter of these technologies.

Both companies faced separate legal challenges, but for different reasons. Terraform Labs dealt with accusations about the fundamental design of their algorithmic stablecoin system, while Galaxy’s problems centered on their promotional practices and trading behavior. The crypto regulatory action NY shows how prosecutors can pursue multiple angles of the same ecosystem collapse, holding different parties accountable for their specific roles in investor losses.

What This Costs Galaxy Digital

Being the crypto firm Galaxy Digital fined $200 million hurts, but it won’t kill the company. Galaxy has diversified income streams and enough cash flow to handle the payments. The bigger challenge will be rebuilding trust with investors who now know the company was playing games with their money.

The fact that Galaxy Digital pays $200M settlement NY authorities is sending shock waves through the crypto investment world. Other major crypto firms are watching this case closely and quietly reviewing their own promotional practices. The message is clear: regulators now have the resources and expertise to investigate complex crypto trading patterns.

What Crypto Investors Can Learn

The Luna crypto fraud settlement 2025 won’t bring back the money lost when Terra Luna collapsed, but it does teach valuable lessons about evaluating crypto investments. The key insight is simple: when investment firms aggressively promote specific tokens, investors need to know whether those firms are betting their own money on the same assets.

Here’s a practical approach: before investing based on any firm’s recommendation, research their actual holdings and recent trading activity. If a company is telling you to buy something while they’re selling it, that’s a major red flag. This applies whether you’re looking at traditional stocks or the latest crypto tokens.

The New York AG Luna settlement details reveal warning signs that investors missed. Heavy promotional campaigns combined with undisclosed trading positions should trigger immediate skepticism. When someone pushes an investment really hard, find out what their own financial stake looks like.

What This Means for Crypto Regulation

This settlement proves that cryptocurrency markets operate under the same basic rules as traditional finance. The Galaxy Digital Luna lawsuit explained shows regulators applying standard market manipulation laws to digital assets. Whether you’re trading stocks on NASDAQ or tokens on a crypto exchange, the same anti-fraud principles apply.

The Terraform Luna legal settlement New York cases demonstrate that crypto companies can’t use technology as an excuse for questionable business practices. Regulators have learned enough about blockchain technology and digital assets to build strong legal cases against market manipulation.

Practical Lessons for Crypto Participants

This Galaxy Digital regulatory fine Luna tokens case establishes clear boundaries for crypto market behavior. Companies promoting specific tokens must disclose their own positions and trading activities. No more secret selling while publicly cheerleading.

State and federal regulators now have teams dedicated to monitoring crypto markets and investigating suspicious trading patterns. The days when crypto operated in a regulatory gray area are over.

What Happens Next

Galaxy Digital continues operating under strict new compliance requirements that other crypto firms are already implementing voluntarily. This case reinforces basic investment principles that apply across all asset classes: investigate who’s giving you investment advice, understand their financial incentives, and be skeptical of opportunities that seem too good to be true.

The $200 million settlement creates a clear precedent for how regulators will handle future crypto market manipulation cases. Both investment firms and individual investors benefit from these clearer rules because they help maintain fair markets where everyone operates under the same standards.