Why We Fall for Crypto Scams: The Psychology of Crypto Fraud & Prevention Tactics

Why people fall for crypto scams is not about intelligence – it’s about human psychology. Successful professionals have lost $850,000 to crooks who figured out their weak spots. This stuff happens to anyone, and understanding how crypto fraud scammers manipulate victims can save your money.

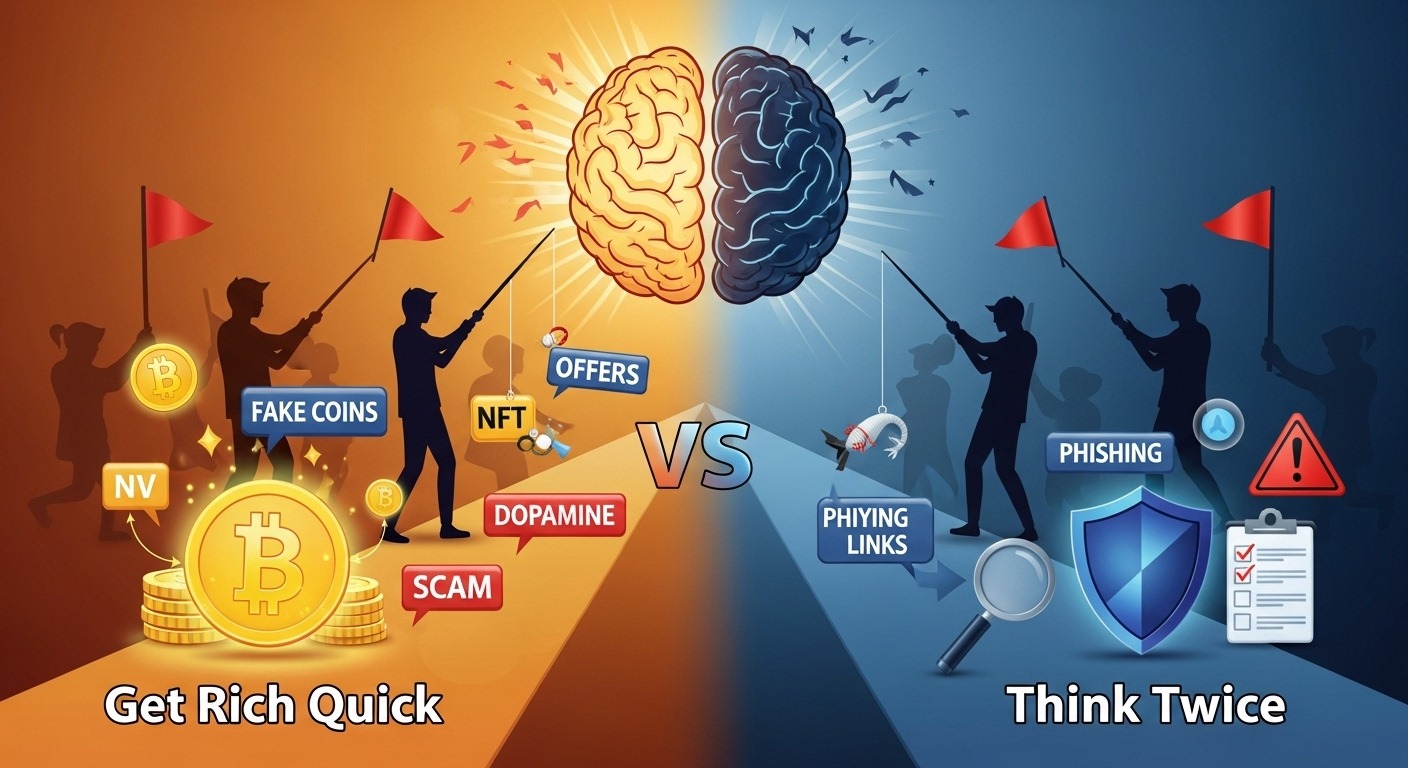

How These Fraudsters Play Mind Games

The psychology of crypto scams is pretty straightforward once you break it down. These criminals study what makes us tick, then use it against us. They’ve got three main tricks: making us greedy, scared, or trusting the wrong person.

Here’s the thing about behavioral triggers for crypto fraud – they work because they’re based on normal human reactions. When someone waves easy money in your face, your brain wants it, when they say “act now or lose out,” you panic &. when your buddy recommends something, you trust them.

Crypto fraud psychology isn’t rocket science. It’s just good old-fashioned manipulation dressed up with fancy technology.

The FOMO Trap: When Opportunity Blinds Us

FOMO crypto scam operations are probably the most common psychological trick in the book. Here’s how a typical fake crypto opportunity scam works:

You get a random message saying “Your account has been created” with login details for some exchange platform. Curious, you log in and see $10,000 sitting there. Your brain starts racing – free money, right?

But when you try to withdraw it, they say you need to deposit $1,000 first to “verify your account” or “cover fees.” The greed kicks in. You think you’re about to make $11,000 for a $1,000 investment. So you send the money.

The website disappears. Your money’s gone. The $10,000 was never real.

One victim told me: “I knew it seemed too good to be true, but the money was right there on the screen. I thought I was smarter than whoever made this mistake.”

This is overconfidence in crypto investing at its worst. Even experienced traders fall for these crypto FOMO scams because they think they’re taking advantage of someone else’s error. The scammers know this and use it against us.

Trust-Based Crypto Scams: The Inside Job

Trust-based crypto scams hurt the most because they come from people we know. Internal crypto theft cases are becoming more common as companies handle their own crypto operations.

Here’s a real example: A tech company decided to process crypto payments in-house instead of using third-party services. They had talented engineers, secure systems, everything looked good. Months later, their financial controller noticed something weird – ad sales were through the roof, but revenue was missing.

Turns out, someone had tweaked the payment system to redirect millions in crypto to an unknown wallet. The company never recovered the funds and never found out who did it. The insider crypto theft destroyed not just their finances but their trust in their own team.

This shows how scammer psychological tricks crypto operations use our natural tendency to trust people close to us. We don’t expect betrayal from colleagues, friends, or family members. That trust becomes a weapon against us.

Power Games: When There’s No Way Out

Some scammers don’t rely on greed or trust – they create situations where victims feel trapped. The REvil ransomware crypto case is a perfect example of how emotional manipulation in crypto scams works at an organizational level.

These hackers specifically targeted companies with ransomware insurance. They broke into an insurance company, got the client list, and went after those businesses knowing they’d be more likely to pay up. This wasn’t some random attack – it was straight-up psychological warfare. These companies got stuck between a rock and a hard place: pay up or watch their confidential data get dumped online, leading to lawsuits and reputation damage that would cost way more than the ransom.

The scammers knew this. They picked targets who’d feel trapped with no good options.

This emotional crypto fraud approach works because it exploits our fear of consequences rather than our desire for gain. When people feel cornered, they make desperate decisions.

How Scammers Steal Crypto Wallets Through Psychology

Understanding how scammers steal crypto wallets isn’t just about technical security – it’s about recognizing the psychological manipulation that gets people to hand over their private keys willingly.

The Romance Angle: Scammers build fake relationships over months, then claim they need help with a “crypto investment opportunity.” Victims send money to help someone they think they love.

The Authority Play: Fake customer support agents contact users claiming their accounts are compromised. They create urgency and fear, then ask for seed phrases to “verify” the account.

The Social Proof Trap: Fake testimonials and success stories make scams look legitimate. When you see others supposedly making money, you want in too.

These scammer tactics in Web3 all rely on the same principle: get you to act emotionally instead of rationally.

Real Stories That Teach Us

Crypto fraud real-life stories show us patterns we can learn from. One investor lost $850,000 to a fake DeFi platform that promised 40% returns. The website looked professional, had fake team photos, and even fake partnerships with legitimate companies.

He told me: “I did research, but I wanted to believe it was real. The returns were incredible, and I thought I’d found something others hadn’t discovered yet.”

This is behavioral finance crypto scams in action. Our desire for exceptional returns makes us rationalize obvious red flags.

Another case involved a blockchain trust scam where fraudsters created a fake charity accepting crypto donations for disaster relief. They used real photos from news events and professional-looking websites. Donors thought they were helping victims, but the money went straight to scammers’ wallets.

Crypto Scam Prevention Tips That Actually Work

Before Any Investment:

- Take 24 hours before making any crypto decision – emotions cool down, logic kicks in

- Research everything independently – don’t rely on information from the source

- Ask yourself: “If this opportunity is so good, why are they sharing it with me?”

- Check if the platform/company is registered with relevant authorities

Red Flag Recognition:

- Guaranteed returns (nothing in crypto is guaranteed)

- Pressure to act immediately

- Requirements to recruit others

- Requests for private keys or seed phrases

- Professional websites with no verifiable team information

Digital Asset Fraud Prevention:

- Use hardware wallets for significant holdings

- Enable all available security features

- Never share private keys with anyone

- Verify all communications through official channels

Learning from Crypto Scams: The Recovery Mindset

Crypto scam recovery stories often share common themes. People who bounce back fastest are those who view their loss as expensive education rather than permanent failure.

One victim of a $50,000 scam told me: “I spent months feeling stupid, then realized the scammers were professionals. They do this full-time. Of course they’re good at it.”

Look, this mindset matters for crypto scam prevention for beginners and pros alike. Getting scammed doesn’t mean you’re dumb – it means you’re human. Once you accept that, you can learn from it and do better next time.

How Technology Fights Back

Companies like Crystal blockchain intelligence are changing the game for law enforcement and financial institutions. Their crypto transaction monitoring tools help track stolen funds and identify scammer networks.

Crystal blockchain tracks scammers by watching how money moves between wallets and spotting patterns that crooks leave behind. When authorities get this info quickly, they can actually catch these guys and sometimes get stolen crypto back.

The cool part? These blockchain trust scam detection systems can spot trouble before you lose money, not just after the damage is done.

What Cops Taught Us About Fighting Back

The Hansa takedown was brilliant. Instead of just shutting down this illegal marketplace, Dutch cops let it keep running for a whole month while they secretly watched everything.

They gathered intel on over 10,000 users and thousands of transactions every day. When they finally pulled the plug, they had enough evidence to bust people all across Europe. Instead of stopping one website, they took down an entire criminal network.

The lesson? Good crypto scam prevention takes patience, not panic. Build solid security habits, keep learning about new threats, and pay attention to what others went through.

Here’s What Really Matters

Crypto scam examples psychology proves one thing: falling for fraud doesn’t make you stupid. These crooks are professionals who know how to mess with your head using fear, greed, and trust.

Your best defense? Mix good security with common sense. Use hardware wallets, turn on every security feature you can find, and pay attention when your gut tells you something’s wrong.

Real opportunities don’t force you to decide right now. They don’t promise crazy returns with no risk. And they don’t make you ignore obvious red flags.

Trust yourself. If something feels sketchy, it probably is. The crypto world has real opportunities, but protecting what you’ve got comes first.